Lately I feel as if I am just going deeper and deeper into darkness. I have so many thoughts swirling around in my head, I am not sure if I can get them into this post in a coherent fashion, but I will do my best.

In some of my other posts, I have detailed my winding road into alcoholism and depression. While I worked hard to beat the bottle, I just can’t shake the feelings of self pity and worthlessness. I tell myself that it is all in my head, but arguing with myself never seems to get me very far.

I remember when I was younger, I was so full of life. There were so many possibilities, I always smiled, I enjoyed myself. When people talked badly about me, I laughed it off. I had confidence and grace, I was fashionable, and I loved what I saw in the mirror. I was also so much more creative, sensitive, and caring. When I think about that young woman, I can’t help but wonder…where did she go? What happened here?

I always end up with the same few answers.

- I left a job that I loved to enter law school.

- I have been arrested twice, and I feel like I have ruined my career and chance at success.

- My marriage fell apart.

- I let myself go.

- I have no real friends left.

- My family is often cold and distant.

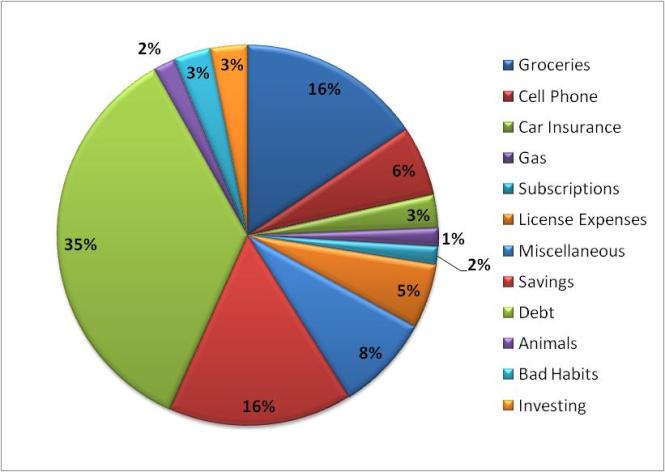

- I am in a financial disaster.

More than those…I am stuck. I am mentally, physically, and emotionally stuck. I can’t seem to motivate myself to do anything. Even though I don’t take meds, I am near the point that I would try an anti-depressant; anything to change this cloud that is constantly hanging over me. But – no health insurance, because I had health insurance through my job…then I switched over to my (ex) husband’s insurance…then switched jobs to a small employer who doesn’t offer affordable plans…then got divorced and lost my ex’s insurance. I got on the Marketplace but it doesn’t kick in until January and I think everything is too expensive despite having insurance anyway.

I also became so unhealthy. I don’t eat right, I barely exercise, I smoke hookah like it’s going to be outlawed, I drink Coke Zero and coffee instead of water…and I know I am doing all of these things, I am aware that it is bad in the moment that I do it, but I can’t change it. I am really my own worst enemy, and I am starting to lose this fight against myself.

I have been writing this for 2 hours now. It is incomplete and I have no plot or conclusion. Can you see what I mean? Someone help me…