Ah, finances. I truly view money as a necessary evil. I’m not a materialistic person. I want to be a millionaire not so I can ring a bell every time I want orange juice, but rather, so I can invest in other people’s businesses, start charity organizations, and be able to be an influential person (I know you can do this as a poor person, and probably more effectively…but I’m not a saint and hunger strikes don’t suit me).

All of those lofty goals are in the future. Right now, in front of my face, is reality. Thanks to law school and overall ignorance about money, I am somewhere near $200K in debt. You would think I am incredibly depressed and that it consumes me – but you would be wrong! I am excited about the debt because paying it off is a project, and it has encouraged me to form a scholarship fund later in life. It also makes me want to publish a story or become a public speaker at local schools to warn kids about what can happen in college and encourage them to save. I was unbelievably dumb, and I learned a lot about finances in the last couple of years – just in time to start paying for my mistakes.

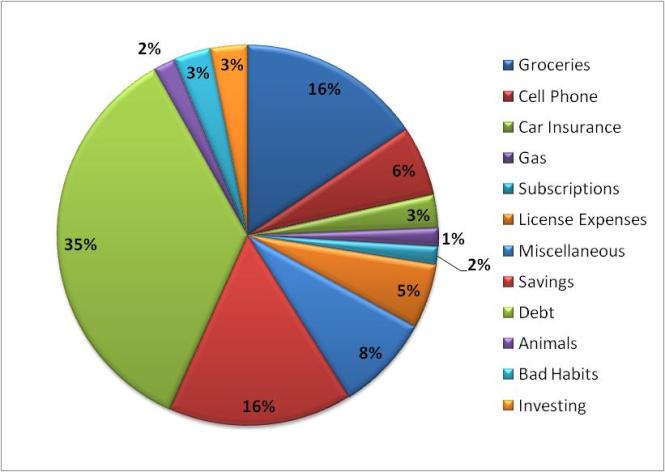

I would rather not talk about my income, but here is where my money goes currently:

I would encourage anyone who is currently not dead to make a chart like this. I keep good track of my finances; however, seeing them in a chart like this really causes me to consider whether I am doing the right thing. Let’s talk specifics.

- Debt. The largest percentage of my income is going toward my debt. I think this is a positive thing, because the longer I allow the debt to sit around, the more interest it collects. Also, the quicker I pay off my debt, the more money I have available to pay on other things. What I don’t know: Every month, my student loan debt interest exceeds the amount I am paying. Each month, I am paying down interest, but not any principal. I desperately need to find out whether the Income Based Repayment Plan I am on includes Loan Forgiveness. If it does – I am definitely going to pay the minimums! If it doesn’t…I am going to continue to live very humbly and even downgrade a few things to get that bad boy paid off in 5 years. My other debts include a couple credit cards (I had a brush in with the law a few years back, and it was expensive + I was broke). I utilize the “snowball method,” which means that I throw all the extra money I can at the smallest debt I have while paying the minimum on all other debts. Eventually, I pay off those small debts one by one, and use what I would be paying on the small debt monthly contributions to chisel away at the larger debts on my list. The snowball method has gotten one card completely paid off, one is at 35% utilization, and my big daddy card is at 60% utilization. I also have some things that are not collecting interest, so I continue to make the minimum payments there; but will throw extra cash at them once my cards are paid.

- Savings. Because this chart illustrates my take-home pay, the contributions I make to my IRA (6% of my salary, plus 50% employer contribution) are not included here. Realistically, I am saving closer to 20% of my salary with that factored in. I think that is a pretty decent percentage. Currently, I have $4,700 in savings, and my goal is to increase that to $15,000 before making any serious moves (like buying a franchise, quitting my full time job, etc.). My savings balance isn’t the worst – but considering I started saving in 2016, I am off to a good start.

- Groceries. I don’t eat out much, but my groceries are still out of control. I LOVE to cook. I live for it. In my house, a week’s menu may include 4-5 exotic dishes, 2 full gourmet breakfasts, homemade “junk” food, and various other snacks and (occasionally) convenience food. I don’t know how to save money here. Help me. 😦

- Bad Habits. I promise I’m not buying heroin, but I do occasionally enjoy wine and we have hookah. I know like I know like I know I need to stop smoking, especially since it is becoming a bit of a problem (e.g. I don’t like to admit how much I smoke it, sometimes I smoke when I don’t even really want it, etc.). I have been smoking it socially for over 10 years. I got my own during law school and used it as a release; and it started becoming a full on addiction about 3 years ago. I don’t have much else to say. I know I need to stop, but I know that in the abstract. So far, I don’t have a compelling reason to besides my (future) health. Isn’t it crazy that it isn’t enough? Maybe I should go to therapy or get an accountabili-buddy.

- Other. The only other things that are a little ridiculous are mindless spending (Groupon, gourmet food for my animals, subscriptions, etc.). Cutting these out would save me about $200 a month ($2,400 a year). Is it bad that I don’t care that much? I am making a great amount of money, and my partner is as well. We enjoy ourselves, but we also aggressively save. Besides my debt, what would I spend this on? Oh yeah…

- Charity. Missing from the chart above is CHARITY. For someone who thinks about animals and those less fortunate more than I think about myself, why am I not donating? Next on the agenda is to decide where I can cut out $100 a month to make a difference.

My long term financial goals are, of course, to get out of debt, start a business, and be able to start my own non-profit. I don’t have kids yet. If that happens, naturally my goals will shift to accommodate children’s clothing, college funds, etc. We’ll worry about that when we get there.

How does this budget look? Are there things I should change/do differently? What do you do to cut corners?